Crunching numbers. Please wait...

Capabilities

Turning complex dealer positioning into clear, automated ratings and actionable signals.

A Decision Engine Powered by Option Structure

Trading Volatility analyzes gamma structure, vanna, charm, implied volatility, and skew to determine directional bias and volatility regime across a broad universe of stocks and indexes. Rather than charts alone, the platform converts option-market dynamics into automated ratings and decision-support signals you can act on.

Automated Stock Ratings

- Ratings for ~1,000 optionable stocks and major indexes

- Updated twice daily by default:

- Once in the first 40 minutes of the trading session

- Again in the final 40 minutes before market close

- Premium subscribers can request on-demand updates intra-session

- Each rating reflects the most likely directional bias implied by current option structure

Ratings are intended as an initial decision-support and screening layer — helping you prioritize where deeper analysis or execution may be warranted.

| Score | Classification |

|---|---|

| 5 | Bullish |

| 4 | Hold |

| 3 | Avoid |

| 2 | Wait |

| 1 | Bearish |

What Drives the Ratings

Ratings are automatically generated using a rules-based algorithm that evaluates:

- Net gamma exposure by strike and expiration

- Proximity to dominant gamma concentrations

- Effects of changing implied volatility on dealer hedging

- Time-decay-driven delta shifts near expiration

- Directional demand for calls vs puts

- Downside vs upside risk asymmetry

- Weekly, monthly, and multi-expiration interactions

- Short-dated dominance in intraday behavior

These inputs are combined to assess whether market-maker hedging behavior is more likely to stabilize price (mean-reverting environments) or amplify price movement (trend-prone environments).

Gamma, Vanna & Charm Analytics

Trading Volatility provides dedicated analytics pages for deep inspection of dealer positioning, including:

- Net Delta Exposure

- Net Gamma Exposure (GEX)

- Vanna Exposure

- Charm Exposure

- Estimated daily hedging flows (gamma, vanna, charm)

- Distribution of exposure by strike

- Interactive charts and visuals to support interpretation

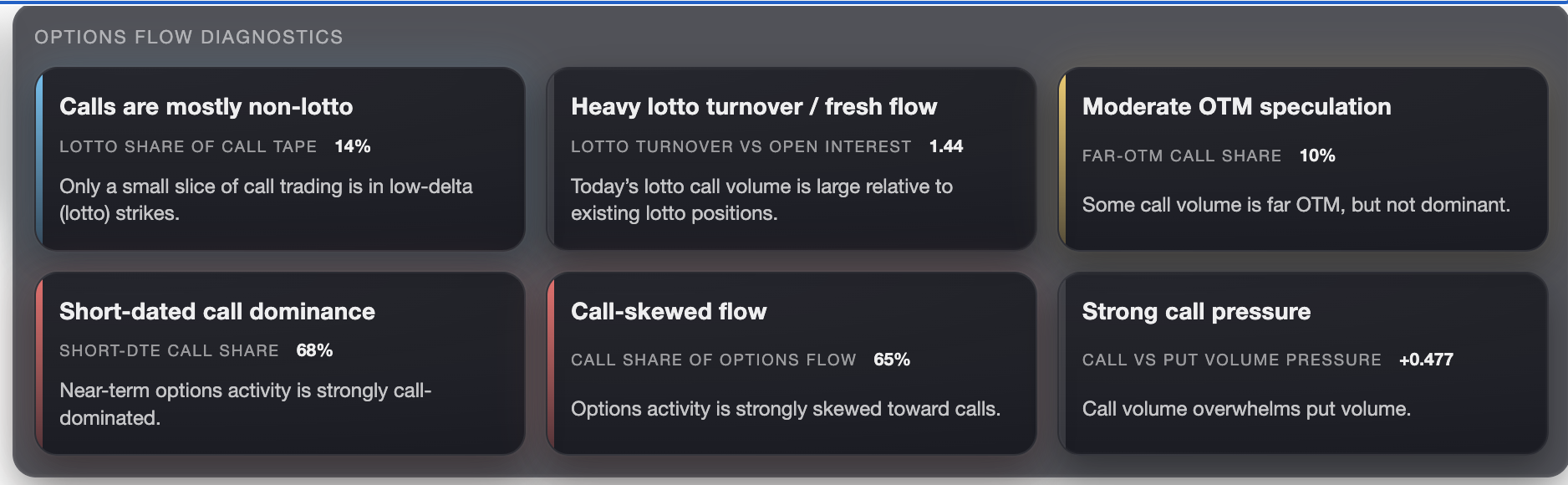

Options Flow Diagnostics

In addition to positioning (GEX / vanna / charm), Trading Volatility now includes Options Flow Diagnostics — a compact layer that summarizes what the options tape is actually doing today. Instead of staring at raw prints, we translate flow into a few interpretable signals: speculation vs structure, short-dated dominance, and call vs put pressure.

- Speculation & Aggressiveness: identifies when call activity is concentrated in low-delta or far-OTM “lotto” contracts.

- Fresh Flow vs Existing Positioning: highlights when today’s volume is unusually large relative to open interest (new participation / churn).

- Near-Term Bias: isolates short-dated activity to show where pressure is building in the next few sessions.

- Pressure: measures how strongly call volume or put volume dominates the tape (beyond simple share).

Flow diagnostics are designed to add context to your gamma levels and volatility regime — helping you distinguish structured hedging/overwrite from speculative demand.

- Lotto share & turnover vs OI

- Far-OTM call share

- Short-DTE call share

- Call share & call/put pressure

My Dashboard — Watchlist & Signal Monitoring

My Dashboard provides a centralized view of ratings, signals, and key metrics for a custom watchlist.

- Custom stock and index watchlists

- Sorting and filtering by:

- Bullish / Hold / Avoid / Bearish

- Rating changes

- Signal types

- Fast identification of rating shifts and regime changes

A dedicated My Dashboard Guide walks users through advanced usage and workflows.

Alerts & Notifications

To stay informed without constant monitoring:

- Enable Daily Email Notifications for My Dashboard Summary

- Receive an evening summary highlighting rating changes, new signals, and updates across your watchlist

Gamma Level Exports & Integrations

- Export gamma levels for your watchlist

- Import into TradingView or ThinkOrSwim

Trading Volatility data is accessible via:

- Website

- API

- Discord bot

- Chrome extension

Advanced Market Structure Tools

These tools provide deeper visibility into positioning, flow, and institutional activity for traders who want to go beyond ratings and high-level signals.

- Graphical view of daily put and call volume by strike

- Overlay current gamma levels at each strike

- Analyze breakeven prices for simple options strategies

- Available for ~1,000 tickers and any expiration

- Track intraday SPX options volume alongside gamma levels by strike

- See which strikes are attracting the most recent activity

- Updated every 20 minutes, with real-time updates available

- Designed to support intraday and same-day expiration analysis

- Track daily dark pool activity across ~250 stocks

- Historical view with EMA smoothing to reduce noise

- Designed to highlight institutional accumulation and distribution trends

Additional Analytical Tools

Advanced users can explore:

- GEX Dashboards — cross-universe gamma analysis

- Skew & IV Charts — sentiment and expected-move context

- Historical GEX Charts — regime changes over time

- Dark Pool Charts — institutional activity signals

- Put/Call Dashboard — positioning and sentiment analysis

- Idea Dashboard — surfaced ideas based on option structure

Coverage & Limitations

- Covers ~1,000 stocks and major indexes

- Optimized for liquid option markets

- Stocks below $5 are excluded

- Major news events and macro data can temporarily override option-driven effects

Key Option Structure Concepts Used

- Positive gamma dampens volatility as dealer hedging stabilizes price.

- Negative gamma amplifies volatility as hedging reinforces price movement.

- Gamma influence often peaks near expiration when hedging sensitivity is highest.

- Short-dated options can dominate intraday behavior.

- Concentrated call gamma can cap upside and pin price.

- Heavy put gamma can accelerate downside moves.

- As price moves away from key gamma concentrations, vanna-driven effects from IV changes can override gamma pressure.

A price level where a dominant gamma concentration can stabilize price action, especially near expiration.

Occurs when market makers are short gamma and must hedge aggressively as price moves — often seen in speculative, call-heavy stocks (e.g., TSLA, GME, AMC).

A structure with minimal put gamma and layered call gamma above spot, creating conditions for rapid upside moves and elevated volatility.